[:en _i=”0″ _address=”0″ /]

Recessions are no man’s friend. Over the last few months, talk of a looming economic crisis has been intensifying. Political and economic factors point to questionable outcomes, especially with gas prices continuing to rise. The question on everybody’s minds “Is a new recession around the corner?” continues to trouble business owners and households around the country. To help you better understand recessions and how to protect your small business during economic downturns, we compiled this guide. Let’s dive right in!

Contents:

- What is a Recession

- Recessions That Changed the World

- How Recessions Affect Small Businesses

- Is a New Recession on the Rise?

- How to Prepare Your Small Business for an Upcoming Recession

- Key Takeaways

I. What Is a “Recession”

A.k.a. Economic crisis

According to the National Bureau of Economic Research (NBER), a recession occurs after two consecutive quarters (a.k.a. 6 months) of negative economic growth measured by the GDP of a country. That, however, is not a mandatory prerequisite for the economy to be in a state of recession.

In simple terms, recession refers to an abnormal decline in economic activity in a country or even the entire world. It is evident in employment rates, real income, industrial production, and wholesale trade.

If you are reading this, you are probably old enough to remember the last global recession of 2007. Check the infographics below for a quick overview of the most influential recessions in global history.

II. Recessions That Changed the World

The Great Depression - Infographic

The Oil Crisis - Infographic

The Great Recession - Infographic

“Those who do not remember their past are condemned to repeat it.”

So, here’s a quick rundown of the three recessions that had a big impact on small businesses.

#1 The Great Depression

We have all heard of it. It’s that scary economic time in history books. The Great Depression is considered to be the longest and most significant economic recession in modern world history.

Duration

It started with the U.S. stock market crash in 1929, and it continued until well after World War II, in 1946.

What happened?

Back in the 1920s, the U.S. stock market underwent an enormous expansion. As a result, investing in stocks became the new way to make easy money. The American public got into a frenzy of investing, but with the subsequent crash of Wall Street in 1929, things took a downturn. The “Black Tuesday” of October 29 led to high levels of unemployment (over 20%), deflation, poverty, and homelessness.

The outcome for small businesses

Many small businesses were wiped out after The Great Depression, but those that remained did so for one of two reasons:

1) they had established strong relationships with their clients

2) they diversified their product/service to meet current more predominant needs

#2 The Oil Crisis of 1973

At the end of the Vietnam war, a new era began. Vehicle production was rising, and the need for oil led to higher prices from the world’s leading oil countries.

Duration

It lasted for 16 months, from November 1973 until March 1975.

What happened?

The high government spending due to the war in Vietnam and the quadrupling of oil prices (OPEC’s oil embargo) brought about high unemployment, inflation, and a decline in the national and global economy.

The outcome for small businesses

Workers were laid off, people’s disposable income was reduced, and many small businesses ceased to exist. Again, strong relationships with clients and diversification were the way out for those who remained in business.

#3 The Great Recession

It is safe to say that if you’re old enough to have a business, then you surely lived through this recession.

Duration

It all began in December of 2007, and it lasted well until June 2009.

What happened

Many debate the origins of this recession, but the most influential events that led to it are the bursting of the U.S. housing market bubble at the end of 2007, and the bankruptcy of the fourth largest investment bank in the country in September of 2008 – Lehman Brothers.

The outcome for small businesses

Much like any other recession, small-sized companies took the greatest hit. The percentage of small businesses that went out of business after the 2009 downturn was really high for two reasons:

- Market saturation and intense competition

- Lack of preparation for surviving during a recession

#Bonus recession

The first recession in America’s early history is known as the Panic of 1785. It occurred after the American Revolution and lasted 4 years, thus ending the post-revolution business boom. Why it occurred? A buildup of debts, overexpansion, manufacturing competition from Europe, lack of solid currency, and post-war deflation all played a role in the economic decline.

III. How Recessions Affect Small Businesses

Spoiler: Not good.

The reality of recessions is that they tend to hit small and medium-sized businesses (SMBs) the hardest. When economies shrink, consumers cut their spending, and operational budgets get smaller. This makes it really difficult to successfully maneuver around that tough financial environment, and that is why many companies go out of business.

During economic crises, it is proactive and flexible businesses that manage to stay on the market and survive the downturn.

#1 Reduced Bank Financing

According to the 2012 Economic Report of the President (the Obama administration), small businesses depend a lot more on bank financing than larger businesses. After the Great Recession of 2009, the number of loans given out to small businesses decreased by 31% in the following years. Similar trends have been observed during past economic downturns, as well.

This means each recession will leave small businesses financially vulnerable as they won’t be able to rely on banking support like they used to.

#2 Reduced Cash Flow

Brick and mortar businesses don’t have the luxury of operating with endless cash flow. The money that comes in is tightly controlled because business owners don’t have large cash resources available. Isn’t that the same for your small business?

So, if a payment from a client is late, this threatens the entire cash cycle. During economic hardships, customers tend to delay payments or purchases because they themselves are waiting for income to arrive. This results in a chain reaction of delayed payments that slows down business, usually to a point where there is no cash to cover basic expenses. Add the low chance of borrowing from a bank, and it is easy to see why small businesses suffer the most during recessions.

#3 Loss of Demand

Small businesses know their clients, often personally. They know their buying behavior, and it helps them plan their work (production, schedule, budgeting, etc.). If they lose one or two major/ regular clients, it can grind the entire business to a halt.

Loss of demand is usually harder on inventory-based companies where production is planned based on past and current demand. But, even if you are in a service-based industry, suddenly having your schedule cleared of appointments will incur just as many losses. Has this happened to you?

#4 Staff Reductions

Losing business and revenue means businesses need to switch to survival mode and cut their budget as much as possible to keep them afloat. That is where staffing reductions often take effect. They are the first choice for many business owners trying to juggle between expenses they can and cannot cut. It may be easier to lay off a newbie than it is to escape a lease contract.

Although it is the logical thing to do from a business perspective, there is the threat of the remaining workers becoming demoralized and experiencing burnouts.

#5 Reduced Marketing Efforts

One of the main mistakes that small businesses make during tough financial times and economic downturns is they shrink their marketing budget (if they have one at all).

And this is where they go wrong.

Relying on your current customers and hoping they will not cut off your product or service is naive. What is your contingency plan in case you lose 50% of your client base? Marketing is the way to find new customers even in times of a recession. Having an Internet advertising agency by your side is vital.

IV. Is a New Recession on the Rise?

You be the judge.

Talks of a 2020 recession have been circulating for quite some time. Some say it’s not happening, and others advocate we should start preparing for the worst.

Back in September, Harvard Professor and former treasury secretary under President Clinton, Larry Summers, did an interview with The Wall Street Journal, where he said that the likelihood of an economic downturn by 2021 was just below 50%. He stated that despite steady consumer spending, the U.S. industrial sector had been weakened.

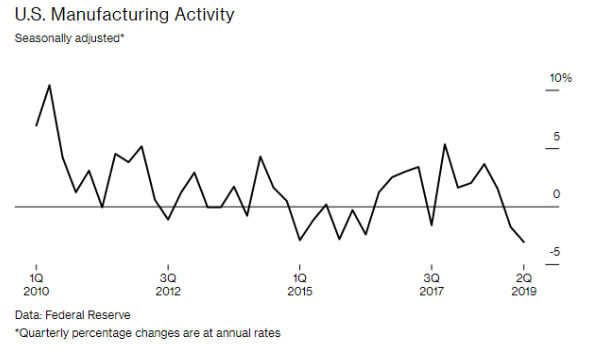

Recessions are closely connected to the rate of industrial production. This is why the Institute for Supply Management (ISM) has created an index tracking manufacturing activity within the U.S. in hopes of spotting downturn trends early on.

Recent years have indeed shown negative results meaning some of the largest factories in the U.S. are operating at reduced capacity. A prime example of this is Kuhn North America Inc., with some of its plants now running at as little as 39% (Kuhn’s painting company) and 50% capacity (Kuhn’s plant in Kansas).

Source: Bloomberg

Why should you care?

By now, you are probably wondering, “Why should I care that some big company is losing business?”

Earlier, we said each recession starts a chain reaction that, like a domino, eventually catches on to small businesses, and it is them that get the final punch.

Let’s see the following picture:

- Large companies struggling to get business and sustain their profits will turn to banks for financial aid.

- Banks will then start refusing loans as they won’t be able to lend money to every business.

- The first businesses they will stop lending to are small companies because they are the ones least likely to be able to pay off their debts.

- This will cause a massive state of cash panic where the most disadvantaged ones will be SMBs.

Do you see how this downturn cycle eventually gets to you and your small business?

There is one more factor that brings about uncertainty whenever economic trouble is right around the corner. If you are following the news, you most certainly have heard about recent tensions between the US and China. This so-called “trade war” has been waging since July of last year, and the outcome is still uncertain.

Imposing limitations on trade on both ends, however, will surely leave its mark, and it will affect small businesses, too.

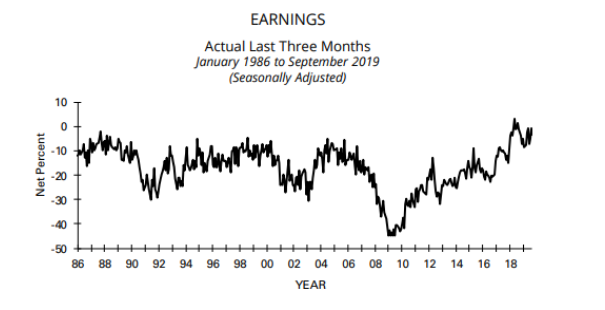

It is not all dark and gloomy. Small businesses have seen a slight increase in earnings over the last couple of years. According to the NFIB Small Business Economic Trends Report of September 2019, we are seeing positive change in terms of what small business owners actually earn at the end of the day.

Source: HFIB Report, Sept. 2019

However, higher earnings, don’t mean a smaller chance of an economic downturn. Some believe that this is, in fact, a prerequisite for financial imbalance and a pre-recession circumstance.

Recession 2023/2024?

What about talks of a recession coming in mid-2023 and the beginning of 2024?

According to economists at Deutsche Bank AG, which is one of the first major banks to predict a recession, we can now expect a recession in mid-2023, and experts at Wells Fargo & Co. forecast the same. Looking at the decades-high inflation, ballooning grocery bills, and record gas prices we have today, it seems like a recession may indeed be right around the corner.

V. How to Prepare Your Small Business for an Upcoming Recession

Historically speaking, it has taken between 6 to 21 months from the actual start of a recession before it is officially announced. This means that by the time you “hear” formal talks about recession, it will already be too late to do something about it.

That is why preparation is key.

#1. Broaden Your Service/Product Offering

No one expects you to be the jack of all trades, but having more than one skill or product to offer will significantly increase your chances of targeting more clients.

Expanding your offering takes time, so you can’t make the change overnight and expect people to know about it and have trust in your expertise. Your advertising efforts need to be focused on marketing your newly added services/products, which means you’ll probably need professional help with that.

Advertising early on is a great way to prepare yourself for a coming recession.

#2. Don’t Cut Back on Advertising Your Business

When trouble comes knocking on the door, many small businesses rush to cut their marketing budget to the bone. Some even eliminate it entirely.

But, it is actually during lean times that your small business needs marketing the most.

In tough financial times, consumers get restless and start looking to change their buying decisions. They research options. It is your job to help them find you and your service/product. You can’t achieve that without marketing. We no longer live in the word-of-mouth only era. Your clients prefer looking for you online instead of on the streets.

And a good Internet advertising agency will be able to get your business at an eye level.

#3. Stick to Basic Expenses

Is there a cheaper place for you to set up shop? Are you overpaying for some services, like your Internet provider? Could you find better deals from other vendors? Instead of cutting all expenses when the time comes, start evaluating your costs now.

You might consider hiring a financial adviser to help you sort that out, as it will be worth it in the long run.

#4. Look for More Clients

Sounds pretty logical, doesn’t it?

But are you doing it?

Getting more clients means better financial security for you and additional sources of income. Given that you are bound to lose some of your clients during a recession, it is always better if you start losing from a higher number of customers.

One of the most efficient ways to generate more leads is by partnering with an SEO company. You can learn more about SEO service providers here.

#5 “Steal” Your Competitors’ Clients by Outranking Them in SERPs

Does that sound difficult to you?

If you have a professional-looking website and an overall strong online presence, you have every chance to do that. “Strong online presence” means you are listed in many local directories, and people can easily find you by doing a quick Google search.

You may have the patience for the phone to ring, but if they don’t have the patience to find you among your competitors, you will have to work on your online presence.

#6 Protect Your Cash Flow

Cash flow is the gas that fuels your business.

For small businesses, it is especially important to keep a constant flow of cash coming in so that when times get tough, they are able to make the necessary payments. It is a good safeguard against falling into the trap of cash panic, too.

One of the strategies you can implement is to shorten the period you give your clients to make the payment of your product or service. Doing so will enable you to set cash aside, and keep things running even business suddenly slows down.

At the very least, you will be able to keep up to date with your bills, and that is sometimes all it takes for you to keep things afloat until the cash starts coming in again.

#7 Keep a Good Personal Credit Score

Recessions make it extremely hard for companies to borrow. This means that if you need a loan to fund your small business, you need to keep a good personal credit rating if you want to stand a chance of getting a loan.

No bank will give you a commercial loan if your personal finances don’t look promising enough. Pay your bills on time, track what goes into the score, keep your credit card balance low, and be smart at managing your debt. Those are all things you can start doing today to improve your credit score and be better prepared for economic uncertainties down the road.

VI.Key Takeaways

The TL;DR

- During a recession, it is small businesses that suffer the greatest losses;

- Chances of a 2023/4 recession are high, and preparing your small business for it asap is key to protecting it;

- There are many measures you can take to safeguard your small business against the dangers of a looming recession. Some of these include:

-

- Broaden your product or service offering;

- Advertisе your business better so you can get more clients;

- Keep a good personal credit score;

- Protect your cash flow;

- “Steal” the clients of your competitors by appearing above them in search results;