Who Are They for & How Can You Apply

The U.S. Small Business Administration’s 7(a) Loan Program is designed to support small businesses across the country who need capital for short or long-term investments. Here is the essence of 7(a) loans, who they are for, how much you can apply for, and their pros and cons.

What Is an SBA 7(a) Loan

SBA’s primary business loan program is the 7(a) Loan Program. These loans are provided through a network of lenders and partner banks nationwide. The SBA guarantees the 7(a) loans up to a specified percentage, which means if the loan is less than $150,000, the SBA will guarantee 85%. Such guarantees are applied to minimize the risk to the lender or partner bank i.

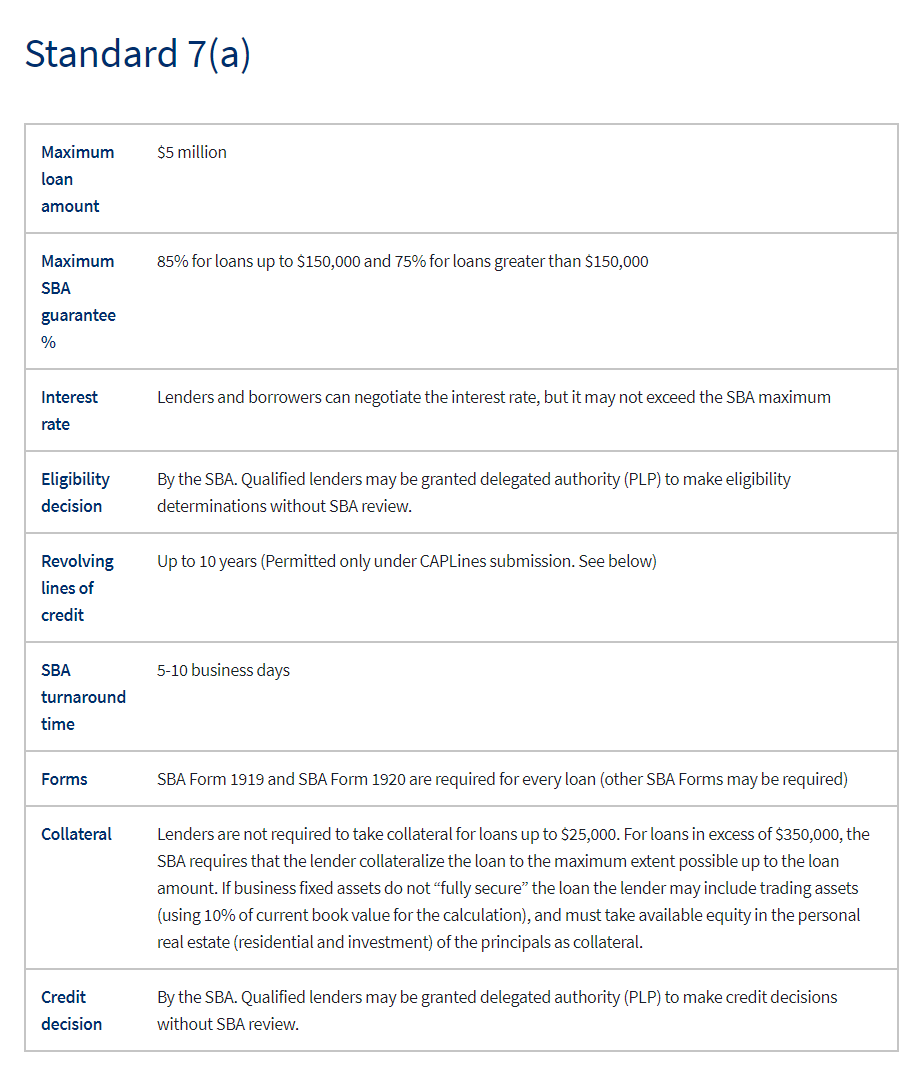

Standard SBA 7(a) Loans

Below are the terms, conditions and characteristics of a Standard SBA 7(a) loan:

What can you use this type of loan for?:

- Buying new business equipment

- Opening a new office/location

- Hiring and training new staff

- Renovating or expanding your current office/location

- Updating computer software or hardware

- Refinancing existing debt (of the business)

- Purchasing commercial real estate

SBA 7(a) loans are a flexible financing option because they allow you to meet a wide range of your business needs.

Other Types of SBA 7(a) Loans

Aside from the standard 7(a) loan, there are other borrowing options with the SBA:

- 7(a) Small Loans

- SBAExpress

- Export Express Loans

- Export Working Capital Program

- International Trade Loans

Who Can Apply for an SBA 7(a) Loan

The good thing about SBA 7(a) loans is that they target almost all kinds of industries and businesses. Whether you have a beauty salon, a construction company, or a restaurant, you can qualify. The basic requirements for eligibility include:

- You are a for-profit basis, i.e. not a charity

- Your business operates in the U.S. market, or you plan to do so

- You are able to invest owner equity

- Before applying for a loan, you have used your personal assets and other financial resources

- Your business can demonstrate revenues and cash flow

Restrictions apply to businesses that:

- Deal in rare coins and stamps

- Are focused on gambling, even if it is legal

- Engage in illegal activity

- Are involved in speculative activities

- Are a bank, lender, financing, insurance, or leasing company

Advantages and Disadvantages of SBA 7(a) Loans

If your business needs a loan and you’re considering the SBA’s options, you need to understand the big picture of all positives and negatives related to your decision. When comparing SBA 7(a) loans and conventional business loans, here are the pros and cons of the first ones.

Pros:

Compared to conventional business loans, SBA 7(a) loans can offer:

- Lower interest rates

- Longer repayment terms (up to 25 years)

- Higher loan borrowing limits

- No risk of balloon payments since most SBA loans are fully amortizing, similar to a car loan or a home mortgage

- Variety of loan options

- Many different types of businesses are eligible to apply

If you are struggling with bank credit score requirements and collateral, and SBA loan can be a great option.

Cons:

There are certain downsides of choosing SBA 7(a) loans for your business:

- Lots of paperwork

- Long approval times

- Collateral is often required

- Typically, a personal credit score over 680 is required

- Some types of businesses, like gambling, lending, and speculation, are prohibited from such loans

- Restrictions may apply on additional financing

How to Apply for an SBA 7(a) Loan

Since the SBA doesn’t give out loans directly, it’s your job to find an SBA-approved partner lender. The Administration offers a referral tool to help connect you to participating lenders. The tool is called Lender Match, and you can find it here.

Once you have found a potential bank or lender, you need to gather all your information and documentation.

Prepare for lots of paperwork, including your loan application history, business plan, business, and personal tax returns, personal financial statements, profit and loss statement, and more.

Check the complete loan application checklist for all required documentation. Make sure to review your assets to see what collateral you could offer to the lender.

As soon as you have all the papers, you can fill out the lender’s application and begin the approval and underwriting process.

You got this.

Remember, first survive, then thrive!

Sign Up For SBA Emergency Loan Info & Other News