A month ago, nobody would have suspected that the world would be facing a pandemic of mass proportions. With governments closing schools and universities, shutting down cinemas and sports centers, monitoring events, and encouraging people to self-quarantine, we are looking at unavoidable challenges for businesses. If you are a small business owner looking for resources to help you deal with the implications of the coronavirus, this blog will help you.

SMBs are found in pretty much every industry today, and while not every small business has yet been affected by the COVID-19 outbreak, financial struggles are expected across the country. Here is what the U.S. government and state authorities are doing to alleviate economic troubles for small businesses.

Update (from March 19th)

The U.S. Senate passed a second bill to expand paid sick leave and free COVID-19 testing later yesterday. This means that if you or your employees wish to be tested for coronavirus, the government will provide funding for such instances. Employers and employees who have tested positive for COVID-19 can have 12 days of paid sick leave, this includes people who aren’t sick but need to take care of those with the virus. More details here.

Source: The New York Times

State-Wide Actions to Help Small Businesses

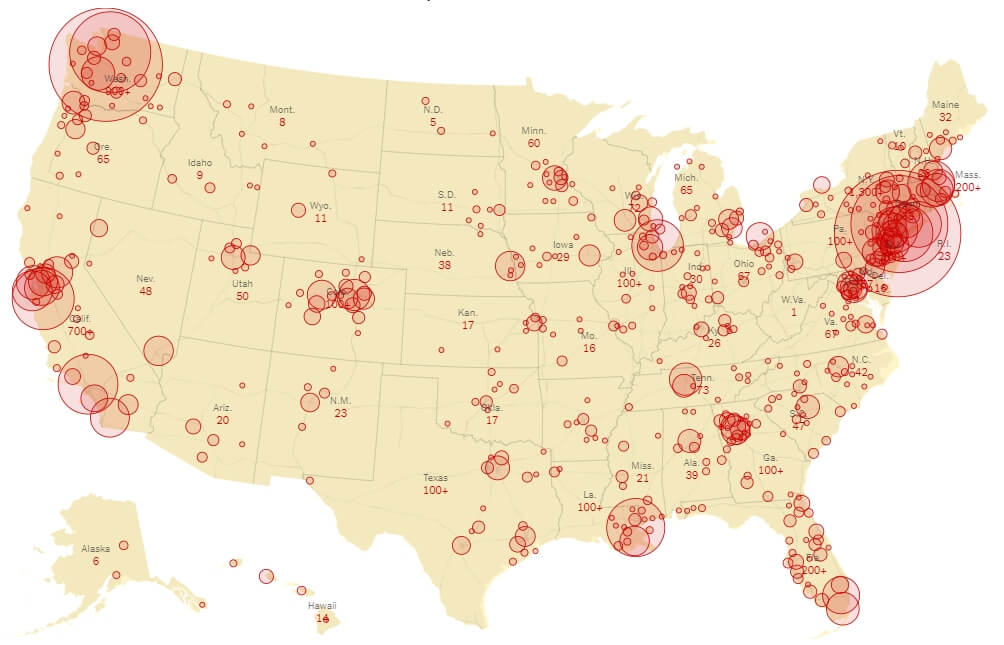

Not all states face the same number of reported cases, with some still in the tenths, and others way over the hundreds. You should track the updates within your state regarding small businesses, and here are some legislative measures that certain states have already taken which means you can expect something similar in yours as well.

Washington

Currently, there are over 1000 reported cases of coronavirus in Washington which has driven the state to enforce social distancing policies. Doing that means many businesses will suffer losses. To help them, the state plans to offer no-interest loans so business owners can deal with cash flow problems, as well as to pass certain bills to aid the affected sectors.

New York

The City Department of Small Business Services has stated it will offer financial assistance to nearly 2,600 businesses. Companies with a 25% drop in sales and fewer than 100 employees can apply for interest-free loans of up to $75,000. Businesses that have five employees or less can get a cash grant to help cover their payroll costs.

San Francisco

The mayor of the city has declared a state of emergency and has allowed several initiatives to help small businesses. They have until 2021 to complete their quarterly tax payments, and the city will also delay collecting Unified License bill payments for the next three months.

Help From Banks and Credit Card Companies

Several banks and credit card companies, such as Capital One, Wells Fargo and Citi, have already issued statements that they are willing to cooperate with clients facing financial difficulties. Citi stated that they will waive the fees on early CD withdrawals, as well as the monthly fees of small business clients (for 30 days). Wells Fargo, on the other hand, made a generous donation of over $6 million to help the public relief effort.

State-Wide Initiatives

The COVID-19 outbreak has caused states to respond quickly to the problems small businesses are bound to experience. Due to the differences in reported cases, the aid initiatives vary greatly across state borders. While the San Francisco Chamber of Commerce plans to petition the government and help low-margin businesses by waiving their fees, other states like Washington (which was the site of the earliest reported outbreak), will provide financial assistance in the form of grants and loans.

The best way to know what measures are being taken in your state is to check with your local governor’s office. You can also check in with your local Chamber of Commerce organization. Visit the Chamber of Commerce Directory to find the closest one to you.

The SBA’s Disaster Assistance Loans

The U.S. Small Business Administration announced it will provide low-interest loans of up to $2 million to small businesses that have suffered “substantial economic injury” because of the coronavirus.

Who qualifies for these loans? Generally, small businesses without available credit are eligible for an interest rate of 3.75%, while nonprofits can qualify for an interest rate of 2.75%. These loans can be used to cover payroll and other business expenses, as well as outstanding debt. You can check whether your state has already applied for disaster assistance here.

Check the Coronavirus Response Toolkit

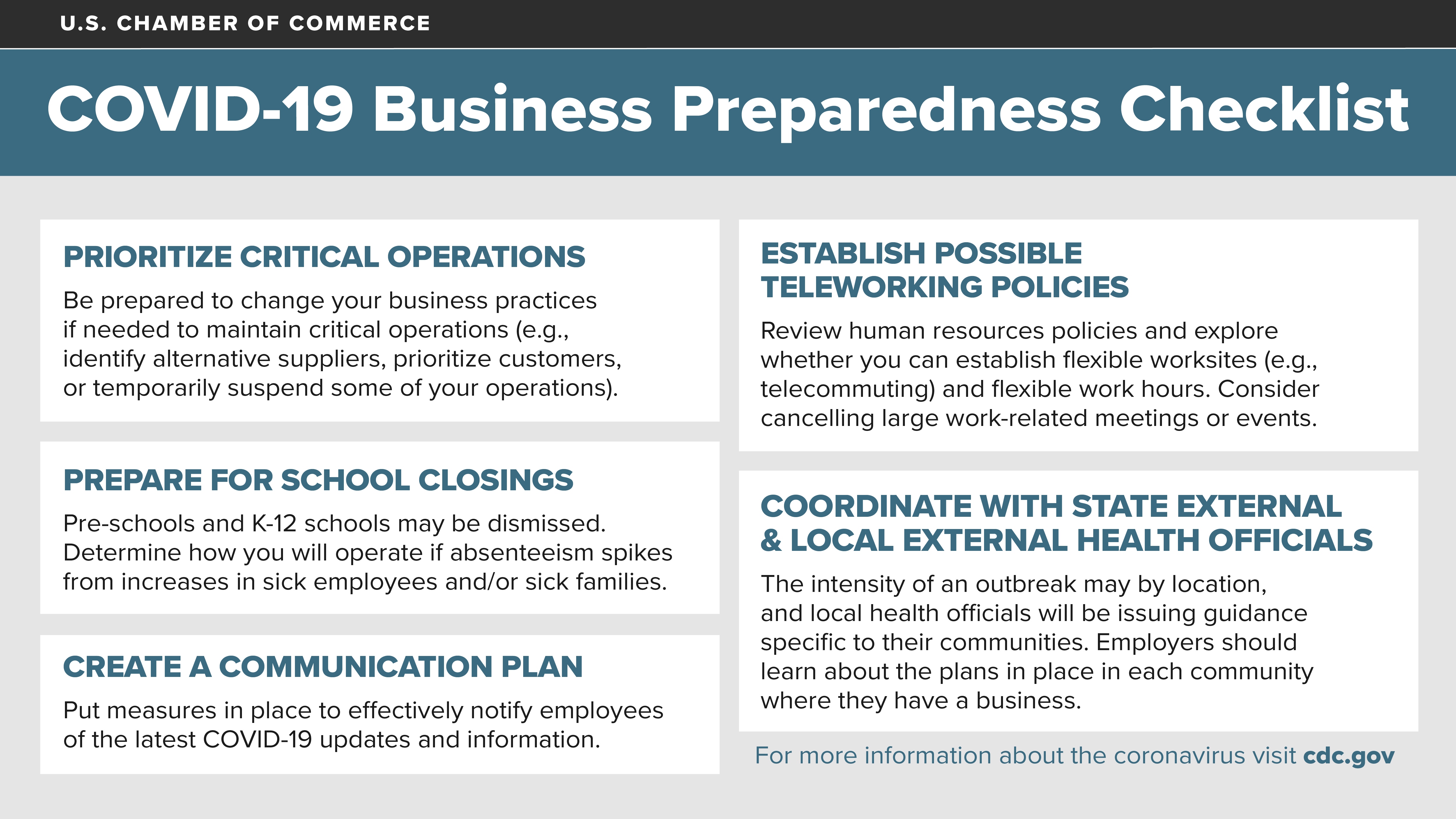

To aid social distancing and promote greater prevention at home and at the workplace, the U.S. Chamber has put together a list of recommendations to encourage businesses across the country to follow CDC-approved guidance. It is about helping you better understand how to keep your employees and customers safe during this challenging pandemic.

You will also find a business preparedness checklist and many other useful resources to help you navigate this situation.

U.S. Treasury Assistance for Small Businesses

Late Friday, the House passed an economic relief plan to support small businesses affected by the coronavirus. Treasury Secretary, Steven Mnuchin said the Treasury will use its regulatory authority to protect businesses concerned with managing cash flows. As for businesses that cannot draw from sufficient taxes, he said the Treasury will “make advances to small businesses to cover such costs.”

At a press briefing earlier that day, President Trump stated that the Bill will pass the Senate vote.

Other Resources

Aside from governmental support, small business owners can also seek financial help from other sources.

For example, Facebook has launched its Facebook Small Business Grants Program to provide cash grants and ad credits to struggling businesses as a result of COVID-19. Details are still scarce, but so far we know the program will be open to up to 30,000 eligible businesses from more than 30 countries worldwide, qualifying for a total of $100 million in grants.

Microsoft Teams Freemium

If your business is subject to a Work from Home regime, Microsoft Teams gives you unlimited chat as well as group and one-on-one video and audio calls. You can have your daily meetings and tasks communicated and discussed with the entire team as long as they have access to the Internet. There is 2 GB of storage per user and a total of 10 GB file storage for teams.

Financial Hardship Relief by American Express

The credit card company evaluates accounts affected by the coronavirus on a case-by-case basis. You can qualify for an interest rate as low as 0%, but if you accept the program, your accounts may be frozen, so make sure you understand all conditions before you do that.

Conclusion

A study by NFIB states that the coronavirus outbreak currently negatively impacts around 23% of small businesses in the U.S., but that number is expected to grow in the coming days and weeks. To ensure you know all measures the government and third parties are enacting to help small business owners like yourself, check in with your local Chamber of Commerce organization and the resources we listed above. Do not panic, work on what you can change (like your online presence), and deal with what you cannot. Stay safe!